In the world of accounting, QuickBooks stands out as a beacon for simplifying financial management and streamlining the complexities of bookkeeping for professionals. Whether you’re an independent accountant or part of a larger firm, understanding QuickBooks pricing structures is crucial to ensure you’re getting the best value while catering to your clients’ needs effectively. This comprehensive guide aims to demystify QuickBooks pricing for accountants, providing all the information needed to make an informed decision.

Overview of Quickbooks Pricing

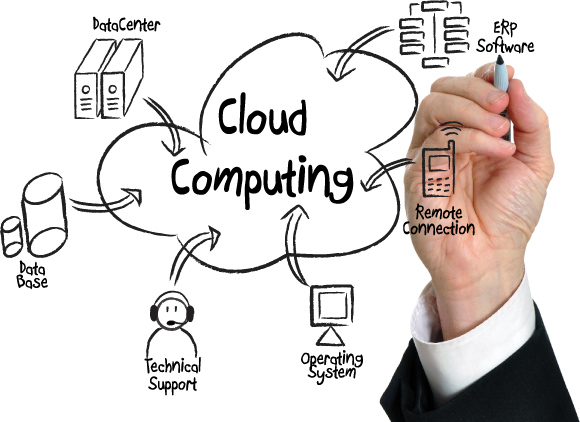

Before delving into the specifics of QuickBooks pricing, let’s first understand the different versions of the software available. QuickBooks offers various products for different types of businesses, including desktop, online, and self-employed options. Each version has its pricing structure, features, and capabilities, catering to the diverse needs of accountants and their clients. The desktop version is a one-time purchase, while the online version requires a monthly subscription fee. On the other hand, self-employed QuickBooks offers a pay-per-use model.

QuickBooks Desktop

QuickBooks Desktop is a traditional on-premise accounting solution that is installed on a computer or server and accessed through a local network. The desktop version offers three pricing plans – Pro, Premier, and Enterprise – each with different features and capabilities.

- QuickBooks Pro: With a one-time purchase price of $399.99 per user (as of 2021), this is the entry-level option for small businesses. It offers basic accounting tools such as invoicing, expense tracking, and inventory management.

- QuickBooks Premier: Priced at $649.99 per user (as of 2021), this plan is ideal for businesses with more complex accounting needs, such as inventory management and job costing features.

- QuickBooks Enterprise: This version is designed for larger businesses with advanced accounting requirements. It offers industry-specific features and supports up to 30 users. The pricing for this plan starts at $1,213 per year for one user (as of 2021).

QuickBooks Online

QuickBooks Online is a cloud-based accounting solution accessed through a web browser. It offers four pricing plans – Simple Start, Essentials, Plus, and Advanced – each with monthly subscription fees.

- Simple Start: At $25 per month (as of 2021), this plan is ideal for sole proprietors or freelancers with basic accounting needs.

- Essentials: Priced at $50 per month (as of 2021), this plan offers more advanced features such as bill management and time tracking, making it suitable for small businesses.

- Plus: This plan costs $80 per month (as of 2021) and includes all the features of Essentials, plus inventory management and 1099s preparation.

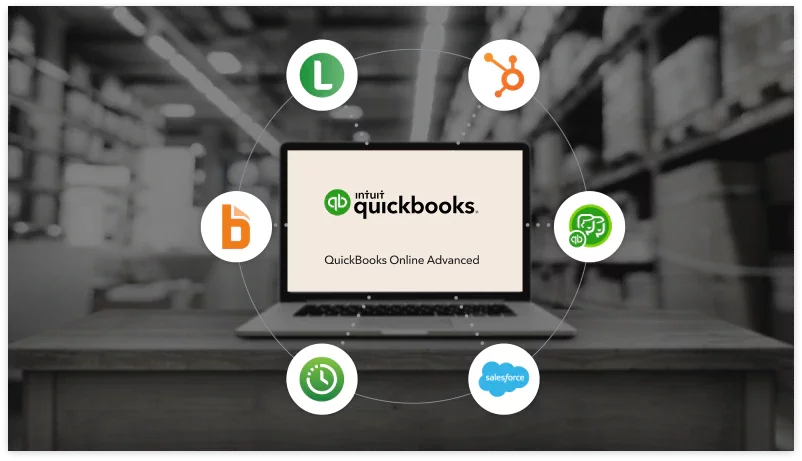

- Advanced: With a monthly fee of $180 (as of 2021), this is the most comprehensive QuickBooks Online plan, offering advanced reporting and batch invoicing capabilities.

QuickBooks Self-Employed

QuickBooks Self-Employed is designed for freelancers and independent contractors who manage their own finances. It is available as a mobile app or accessed through a web browser, with pricing starting at $15 per month (as of 2021). This plan includes basic accounting features such as expense tracking and invoicing, making it ideal for self-employed individuals.

Factors to Consider When Choosing QuickBooks Pricing

When deciding on the most suitable QuickBooks pricing plan for your accounting needs, there are several factors to consider:

- Business size: The size of your business and the number of users who need access to the software will determine which version of QuickBooks is most cost-effective.

- Features and capabilities: Evaluate your business’s accounting requirements and choose a plan that offers the necessary tools and features. For example, if you need inventory management, the desktop or Plus version of QuickBooks Online would be a better fit.

- Budget: Consider your budget and how much you are willing to spend on accounting software. While the online version offers more flexibility with monthly fees, the desktop version involves a one-time purchase cost.

- Scalability: If your business is expected to grow in the future, consider a plan that allows for scalability and can accommodate the increasing needs of your business.

QuickBooks for Accountants: Special Editions

Intuit has developed QuickBooks editions that are specifically catered to the needs of accounting professionals, offering tools and features designed to streamline the complexities of managing multiple clients. Among these specialized versions are QuickBooks Accountant Desktop and QuickBooks Online Accountant (QBOA), each boasting functionalities tailored for the intricacies of advanced accounting tasks.

QuickBooks Online Accountant (QBOA)

QuickBooks Online Accountant (QBOA) stands out as a valuable resource offered for free to accounting professionals. It’s designed to consolidate the management of all your clients’ QuickBooks Online (QBO) accounts into a single, user-friendly interface. Beyond simplifying client account management, QBOA enriches the accounting practice with a range of training resources. These resources help professionals stay up-to-date with the latest accounting standards and QuickBooks functionalities. Collaboration with clients is made effortless through seamless communication tools, enhancing the advisory role of accountants. Additionally, QBOA provides exclusive access to discounted QuickBooks Online subscriptions, which professionals can then offer to their clients, making it a cost-effective solution for both parties.

QuickBooks Accountant Desktop

For those who prefer a desktop solution, QuickBooks Accountant Desktop presents itself as a powerhouse, extending all the robust features found in QuickBooks Enterprise. It is specifically enhanced with accountant-centric tools, such as batch transaction processing, which significantly cuts down on the time required to handle bookkeeping tasks. One of the standout features of the desktop version is the ability to toggle between different QuickBooks versions, allowing accountants to provide support to clients using various editions of the software without the need to have separate installations. This versatility makes it an indispensable tool for accounting professionals who manage a diverse portfolio of clients with varying accounting software needs.

Both versions are designed with the unique challenges of the accounting profession in mind, aiming to provide an efficient, integrated solution for managing client accounts, enhancing service delivery, and optimizing the overall workflow of accounting practices.

Addressing Common User Concerns

Many users express concerns about transitioning to or integrating QuickBooks into their accounting practices. Below are responses to some of these common apprehensions:

- Complexity of Setup and Use: QuickBooks is designed to be user-friendly, offering guided setup and intuitive interfaces across its versions. For businesses worried about the complexity, QuickBooks provides extensive online resources, tutorials, and customer support to facilitate a smooth adoption process.

- Data Security: Security is a paramount concern for Intuit. QuickBooks employs advanced encryption, multi-factor authentication, and regular security audits to safeguard your financial data, ensuring that your information remains secure whether you’re using a desktop or online version.

- Cost Concerns: While the pricing of QuickBooks products varies, it’s important to consider the return on investment in terms of time saved, accuracy in reporting, and the avoidance of costly errors. For those concerned about upfront costs, QuickBooks Online offers a monthly subscription model, which might be more financially manageable.

- Integration with Other Software: QuickBooks offers integration capabilities with numerous third-party applications and services, facilitating a more seamless workflow by connecting your accounting software with other tools your business may use.

- Scalability: Whether you’re a freelancer or a growing enterprise, QuickBooks has a solution tailored to your needs. Users concerned about outgrowing their current plan can easily upgrade to a more robust version or add additional users as their business expands.

By addressing these concerns, QuickBooks aims to reassure potential and existing users of its commitment to providing a powerful, secure, and versatile accounting software suite, capable of meeting the challenges of any business size or industry.

Reviews and testimonials

A quick search of reviews for QuickBooks will reveal a plethora of satisfied users and glowing testimonials, reinforcing its position as a leader in the accounting software field. Users consistently highlight its user-friendly interface, range of features, value for money, and excellent customer support. Many also acknowledge the significant impact it has had on streamlining their accounting processes, improving accuracy and saving time. QuickBooks’ reputation for reliability and ease of use, coupled with its commitment to continuous product improvement, make it a top choice for accounting professionals and businesses alike. Overall, the positive reviews and testimonials speak to QuickBooks’ effectiveness in simplifying complex accounting tasks and providing valuable resources for accountants.

QuickBooks emphasizes customer support and training as fundamental components of its user experience, ensuring users have the resources and knowledge needed to utilize the software to its fullest potential. With a comprehensive support system that includes live chat, email support, and a dedicated phone line, users can find help for any QuickBooks related question or issue. The company also offers an extensive library of tutorials, webinars, and articles through the QuickBooks Learning Center, catering to both new users seeking to understand the basics and experienced professionals looking to deepen their expertise or stay abreast of new features. Furthermore, QuickBooks Accountant University and the ProAdvisor program offer certification courses for accounting professionals, enhancing their proficiency in using QuickBooks and showcasing their expertise to potential clients. This commitment to customer support and continuous learning fosters a supportive environment that not only resolves software issues efficiently but also contributes to the professional growth of its users.

Additional Considerations

Prior to selecting a QuickBooks plan, it is imperative to assess factors such as the specific requirements of your clientele, the scale of the enterprises you support, and the complexity of the accounting functions needed. Furthermore, a determination between a cloud-based or desktop solution should be made based on its alignment with your operational workflow.

The QuickBooks ProAdvisor Program also merits consideration, providing product discounts, dedicated support, and specialized training for accounting professionals. Participation in this program can significantly augment your proficiency in QuickBooks while affording further advantages. Ultimately, the decision on which QuickBooks pricing plan to choose should be made carefully, as it directly impacts the efficiency and profitability of your accounting practice. With this in mind, it is advisable to continuously evaluate and adjust your software solution to best meet the evolving needs of your business and clients. As technology advances, new features and capabilities will become available, making it essential for accountants to stay informed and adapt to these changes to continue providing top-notch service to their clients. Whether you choose the basic plan or opt for a specialized edition, QuickBooks offers a comprehensive and affordable accounting solution for businesses of all sizes. So take the time to assess your needs and explore the different pricing options available, and find the right fit for your business today. Keep in mind, the right software can make all the difference in streamlining your accounting processes and allowing you to focus on growing your business.

Conclusion

QuickBooks presents an array of solutions designed to meet diverse business requirements, ranging from straightforward bookkeeping to intricate accounting tasks. For accounting professionals, the selection of an appropriate QuickBooks plan is crucial in delivering exemplary service to clients. Through a comprehensive understanding of QuickBooks’ pricing structures and features, you can identify the version that best aligns with your practice’s needs, thereby ensuring your clients benefit from superior financial management services. Investment in the correct accounting software extends beyond mere number management; it is about contributing to the success of the businesses you advise.

Whether your preference lies with QuickBooks Online for its ease of access and convenience, or you favor the extensive capabilities of QuickBooks Desktop, there exists a fitting solution for every accounting requirement. By staying abreast of the latest updates and offerings from Intuit, you can enhance the utility of QuickBooks for your practice and the enterprises you assist.

Did you find this ringtone useful?