Car insurance is a legal requirement for drivers in most countries, and it serves as a safety net in case of accidents or other unexpected events on the road. With so many car insurance companies available, it can be overwhelming to choose the right one for your needs. In this guide, we will discuss some key factors that you should consider when selecting a car insurance company to ensure that you are driving with confidence.

Introduction to Car Insurance Companies

Before we dive into the factors to consider when choosing a car insurance company, let’s first understand what these companies do.

Types of coverage for vehicles

Car insurance companies offer various types of coverage for vehicles, including:

- Liability coverage: This type of coverage pays for damages or injuries you cause to others in an accident.

- Collision coverage: It covers the cost of repairs or replacement if your vehicle is damaged in a collision.

- Comprehensive coverage: This covers damages or loss due to non-collision incidents such as theft, vandalism, or natural disasters.

- Personal injury protection (PIP): PIP covers medical expenses and lost wages for you and your passengers regardless of who is at fault in an accident.

Factors to Consider When Choosing a Car Insurance Company

When selecting a car insurance company, here are some important factors to keep in mind:

- Coverage options: It is essential to choose a company that offers the type of coverage you need for your vehicle. Consider not only the minimum legal requirements but also additional coverage options that may provide better protection for yourself and your vehicle.

- Cost: While it may be tempting to go for the cheapest option, it’s important to balance cost with coverage and reputation of the insurance company. Make sure to get quotes from multiple companies and compare their prices before making a decision.

- Financial stability: The last thing you want is an insurance company that goes bankrupt when you need them most. Before choosing a car insurance company, research their financial stability and check ratings from independent agencies such as AM Best or Standard & Poor’s.

- Customer service: In case of an accident or any other issue, you want an insurance company that is responsive and easy to work with. Read reviews and ask for recommendations from friends and family to get an idea of the customer service provided by different companies.

- Discounts: Many car insurance companies offer discounts for various factors such as good driving record, safety features on your vehicle, or bundling multiple policies. Make sure to inquire about potential discounts when getting quotes.

- Reputation: A reputable car insurance company will have a good track record of handling claims efficiently and providing timely assistance to their customers. Research the company’s reputation and read reviews from current or past customers.

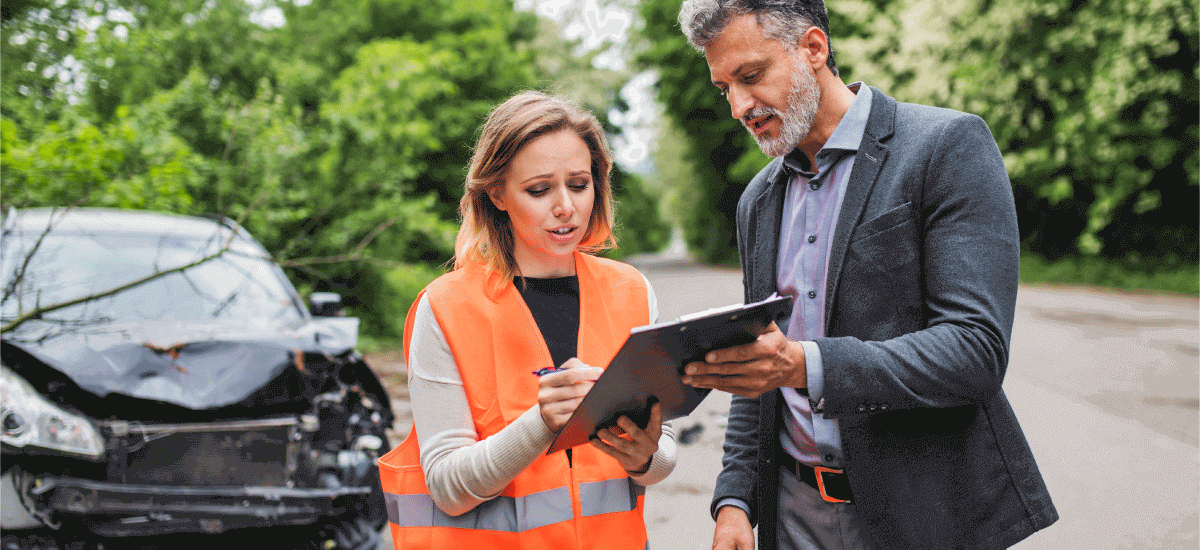

- Ease of filing claims: Filing a claim can be a stressful process, so it’s important to choose an insurance company that makes it easy for you to file and track claims online or through their mobile app.

Key Benefits of Car Insurance

Car insurance offers several key benefits that make it an indispensable part of vehicle ownership:

Protection Against Financial Loss

One of the primary benefits of car insurance is the protection it provides against financial loss. In the unfortunate event of an accident, the costs associated with vehicle repairs, medical expenses, and legal fees can quickly add up. Liability coverage, for instance, protects you from the financial burden of damages and injuries you cause to others. Without insurance, you could find yourself personally responsible for these costs, which may lead to significant financial hardship or even bankruptcy. Comprehensive and collision coverage further safeguard your investment by covering repairs to your own vehicle, ensuring that you can get back on the road without facing excessive out-of-pocket expenses.

Compliance with Legal Requirements

Driving without insurance is illegal in most jurisdictions, and having car insurance ensures that you comply with these legal mandates. Failure to carry the minimum required liability insurance can result in hefty fines, points on your driving record, and even suspension of your driver’s license. By maintaining an active car insurance policy, you not only fulfil your legal obligations but also avoid the penalties that come with non-compliance. Moreover, in the event of an accident, having proper insurance in place can expedite the claims process and shield you from legal repercussions, allowing you to focus on recovery rather than worrying about potential lawsuits.

Peace of Mind

Another significant benefit of car insurance is the peace of mind it offers. Knowing that you have protection against unforeseen events such as collisions or theft helps you feel secure when driving. This assurance allows you to enjoy the freedom of the open road without constantly worrying about the financial implications of potential accidents. With the right coverage in place, you can confidently navigate your daily journeys, knowing that you are safeguarded against the unpredictable nature of driving.

Top Car Insurance Companies in US 2024

With numerous car insurance companies in the market, it can be overwhelming to choose the right one. To help you make an informed decision, here are the top five car insurance companies in the US for 2024 according to Forbes:

- State Farm: With over 16% market share and a wide range of coverage options, State Farm is a popular choice among customers.

- Geico: Known for their competitive pricing and excellent customer service, Geico holds around 13% of the market share.

- Progressive: Offering innovative features such as Snapshot and Name Your Price Tool, Progressive continues to gain popularity with a current market share of around 12%.

- Allstate: In addition to standard coverage options, Allstate offers unique features such as disappearing deductible and accident forgiveness, making them a top choice for many customers.

- USAA: Only available to military members, veterans, and their families, USAA is known for its exceptional customer service and comprehensive coverage options. However, it holds only a small portion of the market share due to its eligibility requirements.

Before choosing an insurance company, make sure to thoroughly research your options and compare their offerings. Ultimately, the best car insurance company will vary depending on your individual needs and preferences. So take your time in evaluating different factors before making a decision that provides you with the right balance of cost-effectiveness and protection.

Here’s details of some above car insurance companies and their offerings:

1. State Farm

State Farm is one of the most recognized names in the car insurance industry, offering a broad range of coverage options tailored to the needs of its customers. Founded in 1922, the company boasts an extensive network of agents who provide personalized service and support. State Farm’s offerings include standard liability, collision, and comprehensive coverage, along with unique features such as roadside assistance and rental car reimbursement. Furthermore, they provide discounts for safe driving, multiple policies, and good student achievements, making it easier for customers to save on premiums. Their user-friendly website and mobile app facilitate easy access to policy management and claims filing, ensuring that customers have a seamless experience.

2. Geico

Geico has become a household name largely due to its memorable advertising campaigns and commitment to providing affordable insurance coverage. Known for its competitive rates, Geico offers a variety of policy options, including liability, collision, and comprehensive coverage, with additional features like mechanical breakdown insurance. Their online quote system is quick and easy to use, allowing potential customers to compare rates and customize their policies. Geico also stands out in the customer service arena, receiving consistently high ratings for responsiveness and support. Moreover, they provide multiple discounts, including those for military members, federal employees, and safe driving records.

3. Progressive

Progressive is renowned for its innovative approach to car insurance, making it a popular choice among tech-savvy consumers. Their unique tools, such as the Snapshot program, allow drivers to save on premiums based on their actual driving habits. The “Name Your Price” tool empowers customers to find coverage that fits their budget while comparing various options. Progressive offers a comprehensive range of coverage types, including liability, collision, and specialized options like pet injury protection and custom vehicle parts coverage. Their strong online presence and mobile app make it easy for customers to manage their policies and file claims efficiently.

4. Allstate

Allstate’s commitment to providing personalized insurance solutions has made it a frontrunner in the industry. With a strong focus on customer service, Allstate not only offers traditional coverage options but also includes unique features like accident forgiveness and a disappearing deductible, which can significantly benefit policyholders over time. Their wide array of discounts—such as those for safe driving or bundling multiple policies—helps customers save on their insurance needs. Allstate’s mobile app allows for easy policy management and claims submission, ensuring customers can get assistance whenever needed.

5. USAA

While USAA is exclusive to military members, veterans, and their families, it remains one of the highest-rated car insurance companies for customer satisfaction and service quality. Known for its commitment to serving those who have served, USAA offers competitive rates, comprehensive coverage options, and excellent customer support. They provide unique benefits tailored to military lifestyles, including coverage for deployed service members and flexible payment options. The company also boasts an array of discounts for safe driving, multiple policies, and vehicle safety features, making it a top choice for eligible members of the armed forces and their families.

When evaluating these companies, consider your specific needs, driving habits, and budget to find the best fit for your car insurance requirements.

How to Compare and Choose the Best Car Insurance Company for Your Needs – A step to step guide

Evaluate your coverage needs

Before diving into comparisons, it’s crucial to assess your own insurance requirements. Consider factors such as the age and value of your vehicle, your driving habits, and whether you need additional coverage for things like personal injury protection or uninsured motorist coverage. If you have a long commute, you may want to explore options that offer higher liability limits. Conversely, if your car is older and not worth much, you might opt for liability coverage only. Creating a list of your priorities can help streamline the selection process and ensure you receive the protection you truly need.

Compare Quotes

Once you identify your coverage needs, it’s time to gather quotes from multiple insurance companies. Many providers offer online tools for obtaining quotes, making it easy to compare prices and coverage options side by side. When requesting quotes, be transparent about your driving history, the specifics of your vehicle, and any discounts you may qualify for, as these factors can impact your rates significantly. Be sure to compare not only the premiums but also the level of coverage included in the quotes, as the cheapest option may not always provide adequate protection.

Review Customer Feedback

As you weigh your options, take the time to read customer reviews and ratings for each insurance company. Look for insights on claims processing times, customer service experiences, and overall satisfaction levels. Websites and platforms that aggregate customer feedback can provide valuable perspectives, helping you gauge the reliability and reputation of each provider. A company with excellent policy offerings may not be worth it if their customer service falls short when you need it most.

Understand Policy Terms

Before finalizing your decision, ensure you fully understand the terms of the policy you are considering. Pay close attention to details such as deductibles, coverage limits, exclusions, and any additional fees. Familiarizing yourself with this information will not only prevent potential surprises down the line but will also empower you to engage confidently with insurers and make informed choices about your coverage options.

In conclusion, finding the best car insurance company for your specific needs involves thorough research, careful comparison, and consideration of customer feedback, ensuring that you remain well-protected on the road.

Conclusion

Choosing the right car insurance company is essential for protecting both your vehicle and financial security. By carefully evaluating your coverage needs, comparing quotes, reviewing customer feedback, and understanding policy terms, you position yourself to make an informed decision. Remember that what works for one driver may not suit another; personal circumstances play a pivotal role in the insurance selection process. Ultimately, a well-selected policy should provide peace of mind, flexible options, and the reliability of excellent customer service. Regularly reviewing your coverage can also yield better premiums or enhanced protection as your life circumstances change. Be proactive and diligent in your approach, and you will find the car insurance that best meets your needs.

Did you find this ringtone useful?