When it comes to driving, having the right auto insurance policy is crucial. Not only does it protect you financially in case of an accident or damage to your vehicle, but it’s also often a legal requirement. However, with so many insurance companies and policies available, finding the best one for you can be overwhelming.

Fortunately, there are steps you can take to make the process easier and ensure that you get the best coverage at the right price. In this guide, we’ll discuss how to drive smart when it comes to finding the best auto insurance policy.

I. Introduction to Auto Insurance

Before diving into the tips for finding the best auto insurance policy, it’s important to have a basic understanding of what auto insurance actually is and how it works.

Auto insurance is a contract between you and an insurance company, where you pay a premium in exchange for coverage in case of accidents or damage to your vehicle. The amount of coverage and the cost of your premium will depend on various factors, such as your driving history, type of vehicle, and location. It’s important to note that each state has its own minimum requirements for auto insurance, so it’s essential to know the laws in your area.

1) Why Auto Insurance is Essential for Drivers

Auto insurance is essential for several reasons, the most important being financial protection. In the event of an accident, having insurance can cover the repair costs for your vehicle and any damages incurred by other parties involved. This coverage helps prevent substantial out-of-pocket expenses that could be financially devastating. Additionally, auto insurance can provide liability coverage, protecting you from lawsuits resulting from accidents where you are at fault.

Moreover, auto insurance offers peace of mind. Knowing that you are protected financially allows you to drive with confidence, free from the constant worry of potential accidents and their repercussions. Furthermore, many insurers offer additional benefits, such as roadside assistance, rental car coverage, and even accident forgiveness, enhancing your overall driving experience. In summary, auto insurance is not just a legal obligation; it is a crucial safeguard for your financial well-being and mental serenity on the road.

2) Types of Coverage

There are several types of coverage that make up an auto insurance policy. These include:

- Liability: This covers any damage or injuries you cause to others while driving.

- Collision: This covers damage to your vehicle in case of a collision with another vehicle or object.

- Comprehensive: This covers damage to your vehicle from non-collision incidents, such as theft or natural disasters.

- Personal Injury Protection (PIP): This covers medical expenses for you and your passengers in case of an accident.

- Uninsured/Underinsured Motorist: This covers damages if you’re hit by someone without insurance or with inadequate coverage.

Before choosing a policy, it’s important to understand the different types of coverage and assess which ones are necessary for your situation. For example, if you have an older car that isn’t worth much, then comprehensive coverage may not be necessary. However, if you frequently drive in areas with a high number of uninsured drivers, then uninsured motorist coverage may be essential.

3) Key Terms and Concepts of Auto Insurance

- Deductibles: The amount you pay out-of-pocket before insurance kicks in.

- Premiums: Regular payments made to keep your policy active.

- Exclusions: Specific conditions or circumstances not covered by the policy. It’s essential to know these to avoid any surprises in case of an accident.

- Limits: The maximum amount your insurance will pay for a covered loss. Be sure to understand the limits of each type of coverage in your policy and consider increasing them if necessary.

II. Tips for Finding the Best Auto Insurance Policy

Now that you have a basic understanding of auto insurance, let’s discuss some tips for finding the best policy for your needs.

1) Research and Compare Quotes

The first step to finding the best auto insurance policy is to do your research. Take the time to compare quotes from multiple companies and see what they offer in terms of coverage and price. Don’t just go with the cheapest option; instead, look for a balance between cost and coverage.

Additionally, make sure to read reviews and check the financial stability of the insurance companies you’re considering. You want to choose a company that has a good reputation and will be able to pay out any claims you may have in the future.

2) Understand Your Needs and Budget

As mentioned, each person’s auto insurance needs will differ based on various factors. Therefore, it’s crucial to assess your specific needs and budget before choosing a policy. Consider these questions:

- How often do you drive?

- What type of vehicle do you own?

- Do you have a clean driving record?

- Are there any special circumstances or risks to consider (e.g., living in an area prone to natural disasters)?

Understanding your needs and budget will help you determine the necessary coverage and choose a policy that fits your specific situation.

3) Take Advantage of Discounts

Many insurance companies offer discounts to their customers, such as safe driver discounts, multi-policy discounts, and student discounts. Make sure to ask about any potential discounts and see if you qualify for them. These can significantly lower your premium and help you save money in the long run.

4) Consider Bundling Policies

If you have other types of insurance policies, such as homeowners or renters insurance, consider bundling them with your auto insurance. Many insurers offer significant discounts for bundling multiple policies with them.

5) Review Your Policy Regularly

Once you’ve chosen an auto insurance policy, make sure to review it regularly (at least once a year). As your circumstances change, so may your insurance needs. It’s important to assess if you need more or less coverage and adjust accordingly. Additionally, reviewing your policy may help you find potential discounts or savings that you weren’t aware of before.

III. Cost-Saving Strategies for Auto Insurance

Auto insurance can be a significant expense, but there are ways to save money on your policy. Here are some cost-saving strategies to consider:

1) Maintain a Clean Driving Record

One of the most effective ways to lower your auto insurance costs is to maintain a clean driving record. Insurance companies often reward safe driving habits with lower premiums. Accidents and traffic violations can raise your rates significantly, so it’s crucial to drive safely and avoid any infractions. Over time, maintaining a clean record can lead to substantial savings on your insurance.

2) Choose a Higher Deductible

Opting for a higher deductible can decrease your insurance premium. A deductible is the amount you are required to pay out-of-pocket before your insurance coverage kicks in. By agreeing to pay more in the event of a claim, you can often reduce your monthly premium. However, it’s essential to ensure that the higher deductible is affordable for you in case you need to file a claim.

3) Opt for the Right Vehicle

The type of vehicle you drive can significantly impact your insurance costs. Generally, sporty or luxury cars tend to have higher premiums due to their increased risk of theft and more expensive repair costs. On the other hand, vehicles with high safety ratings and lower theft rates can lead to reduced insurance costs. When purchasing a car, it’s wise to consider the potential insurance costs alongside the purchase price.

4) Limit Mileage

Many insurance companies offer low-mileage discounts for drivers who do not drive their vehicles frequently. If you can limit your driving to fewer miles each year, you may qualify for this discount. This strategy not only serves to lower your premiums but also reduces your risk of being involved in an accident.

5) Review Your Coverage Needs Over Time

Your circumstances will change over time, and so will your auto insurance needs. It’s important to review your policy regularly and make adjustments based on your current life situation. For instance, if you have paid off your vehicle, you might consider dropping collision or comprehensive coverage if it no longer makes sense financially. Regular reviews can help you ensure you’re not paying for coverage you no longer need.

By implementing these cost-saving strategies, you can effectively manage your auto insurance expenses while ensuring you maintain the necessary protection on the road.

IV. Filing a Claim and What to Expect

In the unfortunate event that you need to file a claim with your auto insurance company, it’s essential to understand the process and what to expect. Here are some steps to follow when filing a claim:

1) Steps to Take After an Accident

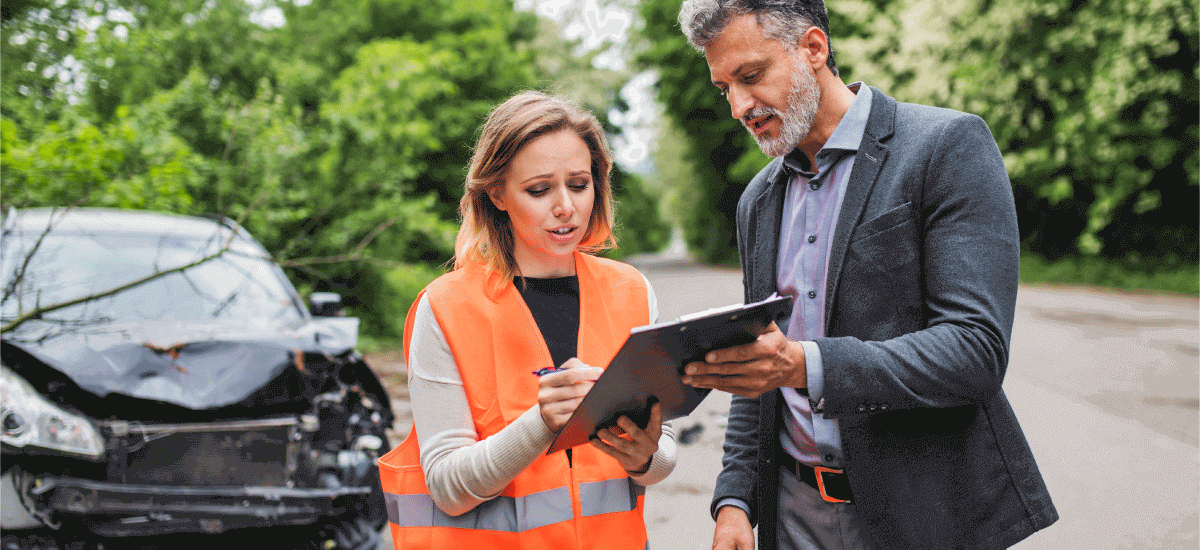

The moments following an accident can be chaotic and stressful. It’s important to remain calm and take the following steps to ensure everyone’s safety and to properly document the situation. First, check for any injuries among all parties involved, and if anyone is hurt, call emergency services immediately. Once everyone is safe, move vehicles to the side of the road if possible to avoid further accidents.

Next, exchange information with the other driver(s), including names, contact details, insurance information, and vehicle registration numbers. Taking photographs of the scene, including any damage to vehicles and the surrounding area, can be invaluable when filing a claim. Additionally, gather contact information from any witnesses who saw the accident occur.

Finally, report the incident to your insurance company as soon as possible, providing them with all the necessary details. This includes the accident’s time and location, a description of what happened, and any evidence you’ve collected. Acting promptly can help facilitate a smoother claims process.

2) The Claims Process

After reporting the accident to your insurance company, an adjuster will be assigned to handle your claim. They will review all the information provided and may conduct further investigations to determine liability and the extent of damage or injuries. If necessary, they may also request a statement from you or any other parties involved.

Once the adjuster has completed their evaluation, they will negotiate with you on a settlement amount. It’s important to keep in mind that insurance companies are businesses and have a vested interest in minimizing payouts. However, if you feel the settlement offered is inadequate, you can appeal it or seek legal advice.

V. Protecting Your Vehicle and Finances With Auto Insurance

Auto insurance is a crucial aspect of being a responsible vehicle owner. It not only protects you and your vehicle in case of an accident but also safeguards your finances. Without adequate coverage, you could be left with expensive repair or medical bills, which can have a significant impact on your financial well-being.

1) The Role of Auto Insurance in Financial Protection

Auto insurance plays a crucial role in safeguarding not just your vehicle, but also your financial wellbeing. By providing coverage in the event of accidents, theft, or damage, it helps mitigate the costs associated with unexpected events. In the event of a claim, your insurance can cover repair expenses, medical bills, and any liability costs, preventing you from facing potentially significant out-of-pocket expenses that could strain your finances. Additionally, having adequate auto insurance can provide peace of mind, knowing that you’re protected against unforeseen circumstances while driving. It’s essential to understand the various types of coverage available and select a policy that aligns with your financial situation and driving habits, ensuring that you strike a balance between comprehensive protection and affordability.

2) Other Ways to Protect Your Vehicle

While auto insurance is essential for protecting your vehicle, there are other steps you can take to further safeguard it. One key way to protect your car is by following a regular maintenance schedule. This ensures that any potential issues are caught early and addressed before they become more significant and costly problems. Additionally, investing in safety features such as anti-theft devices, dash cams, and backup cameras can reduce the risk of theft or accidents and potentially lower your insurance premiums. Finally, practicing safe driving habits like obeying traffic laws and avoiding distractions can help prevent accidents and keep both you and your vehicle safe on the road.

VI. Conclusion

In conclusion, auto insurance is a critical aspect of vehicle ownership. It not only protects you and your finances in case of accidents but also provides peace of mind while on the road. By understanding the various types of coverage available and implementing cost-saving strategies, you can effectively manage your premiums without sacrificing necessary protection. In the event of an accident, knowing what to expect during the claims process can help ensure a smoother resolution. Ultimately, by prioritizing adequate auto insurance and taking steps to protect your vehicle, you can drive with confidence and peace of mind. So remember to regularly review your policy, follow safe driving practices, and properly maintain your vehicle to keep yourself and others protected on the road.

Did you find this ringtone useful?